It’s common for marketers to talk up their willingness to pay more for the context and quality of ads now that chasing the cheapest media impressions is seen as a major faux pas in a transparency-obsessed industry. To balance the quality and price of media, marketers are reconsidering how they buy cheaper inventory with quality KPIs that are tied to business goals.

Here is the state of the pivot to quality in advertising, in five charts.

Anyone can buy programmatic on cost, but few understand its value

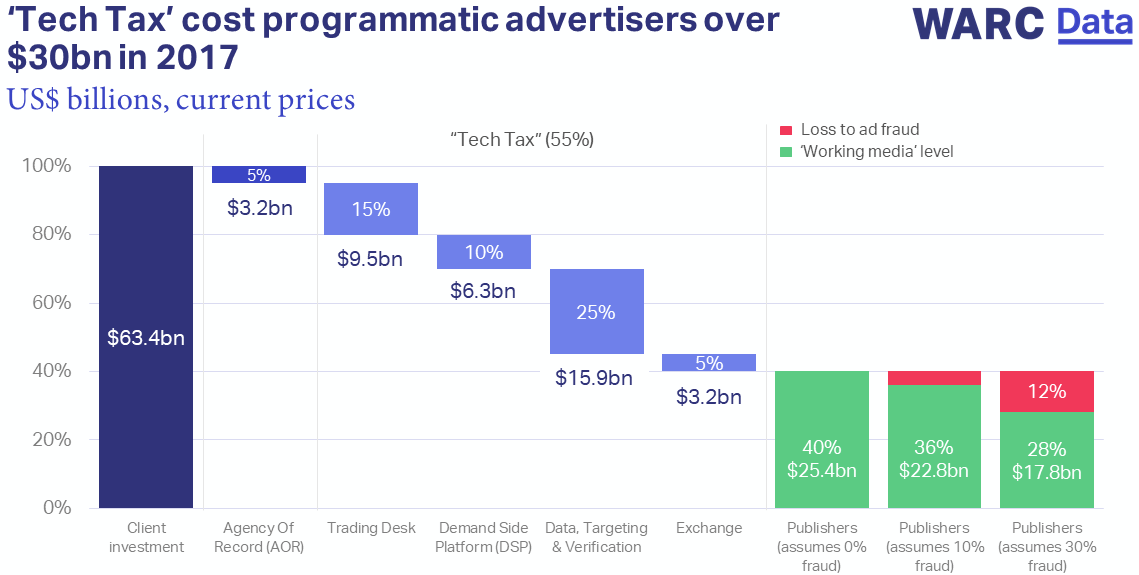

Marketers are focused more than ever on fees levied in the media supply chain. It was only when Duracell understood how much it was spending on hidden fees that it was able to decide what constitutes a fair take rate. Getting that clarity, however, is still a long way off for most brands. Of the $63.4 billion (£45.1 billion) brands spent on programmatic in 2017, as little as 27 percent or $17.8 billion (£12.7 billion) made it to the working media level, according to a Warc report.

Marketers aren’t measuring what matters to their business

It’s generally agreed in advertising circles that chasing a low cost per click without considering the quality of clicks and subsequent action is as destructive as it is self-defeating. Yet clicks are still deemed a key indicator of ad success, per a study of over 200 senior marketers from Infectious Media. Some 56 percent of advertisers cited number of clicks as the most important metric, followed by cost per click (45 percent) and click-through rate (43 percent). This is despite the fact that click data is often distorted by fraud and has been proven to be an extremely flawed metric for predicting a sale.

There are signs that advertisers are finally trying to address the issue. Most of those surveyed (53 percent) are in the process of changing their approach to display measurement, while 44 percent are open to the idea of changing, per Infectious Media. The challenge those businesses face, however, is that the ad industry has grown used to the lack of sophisticated measurement on offer. More than half (56 percent) of the respondents said resistance from their agencies is the greatest challenge to changing the way they measure display, according to the report.

Read More at The Original Article: digiday.com