In just two short years, the market for programmatic video is forecast to reach nearly $20 billion.

But buyers face a market fragmented by different ad units, video players and attribution models — while digital-first sellers face the challenge of adapting to linear TV business models like the upfronts.

Will these obstacles prevent the bullish video forecasts from coming to fruition, or will the industry develop new solutions and best practices to capture that spend?

John Peragine, our SVP and Global Head of Video , answers some of the hard questions about the potential growth of programmatic video.

Can you describe the “state” of video advertising in 2018?

JP: 2017 was a phenomenal year for digital video, and we fully expect the momentum to continue on through this year. At Rubicon Project, we saw a 51 percent increase in our video business last year, actually outpacing the overall forecasted growth rate for programmatic video, according to eMarketer.

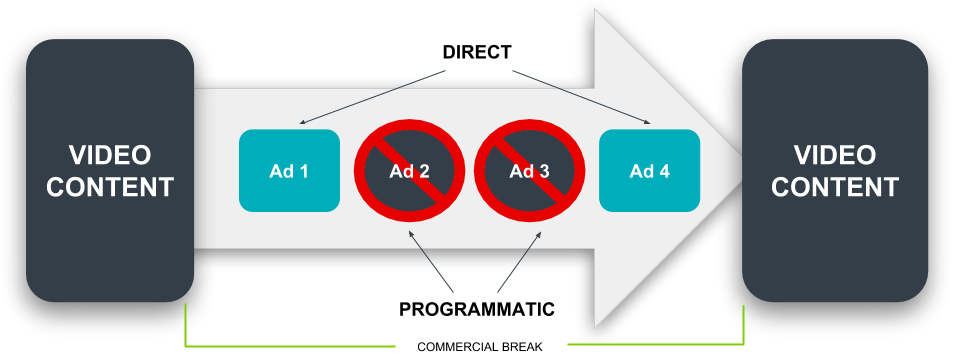

As this year’s video market continues to take shape, we’re seeing publishers making more of their “premium” inventory available programmatically, and also adopting formats like Vertical Outstream to create new video monetization opportunities where there may not have been any before.

On the buy side, DSPs and the advertisers they represent have been heavily focused on scaling video viewers — which is partly why we saw more than 105 billion new video ad requests on our platform last year — with an eye for inventory that comes packaged as part of a clean, safe, “well-lit” deal.

Read More at The Original Article: rubiconproject.com